Experts in alternative investments

Investment

Excellence

Monte Bianco NAIF SICAV PLC is a distinguished Notified Alternative Investment Fund (NAIF), operating under Maltese law . Renowned for its dynamic and multy-directional management expertise, we bring a stable solution to the world of alternative investments.

We believe in offering a diverse range of investment options to meet the unique needs of our investors. Our portfolio is set up to include multiple subfunds, each tailored to deliver specific investment strategies and outcomes. The pinnacle of our strategy is all combined into our Multi-Strategy Monte Rosa fund. Its multi-strategy approach is designed to adapt and thrive in various market conditions, ensuring that your investments stay on the path to wealth preservation and growth.

An Opportunistic Approach

Generating Alpha with Precision

Our pursuit of alpha is guided by a rigorous fund selection process and active management of exposures. The Monte Bianco team implements investment operations skillfully to enhance or temper portfolio choices.

We adopt an opportunistic management style, selectively pursuing the most compelling investment themes of the moment strategically aligned to our core operations. Positioned between fund-of-funds and multi-asset solutions, our approach combines discretion and strategy.

Capital Appreciation

Portfolio Diversification

Our primary goal is capital appreciation in the medium to long term. Monte Bianco NAIF SICAV PLC serves as a valuable tool for portfolio diversification across strategies, asset classes, sectors, and countries.

Experience the Future of Alternative Investments with Monte Bianco NAIF SICAV – Where Opportunity Meets Expertise.

ACTIVITY

Diversified Excellence

Real Estate

Real Estate is a cornerstone of wealth creation. We specialize in global real estate investments, meticulously underwritten to build & preserve wealth through property assets one brick at a time.

Asset backed Loans

Our Loans strategy focuses on intelligent lending practices, providing a path to high returns. We carefully evaluate lending opportunities to maximize profitability and minimize risk.

Private Equity

We excel at identifying and seizing profitable opportunities within this dynamic sector. Our investment partners take an active role in the management and re-structuring of underperforming companies to deliver substantial returns.

Venture Capital

Venture Capital is all about driving innovation. We invest in institutional VC specialist funds focused on fintech startups and marketplaces, fuelling their growth and innovation while potentially reaping significant rewards.

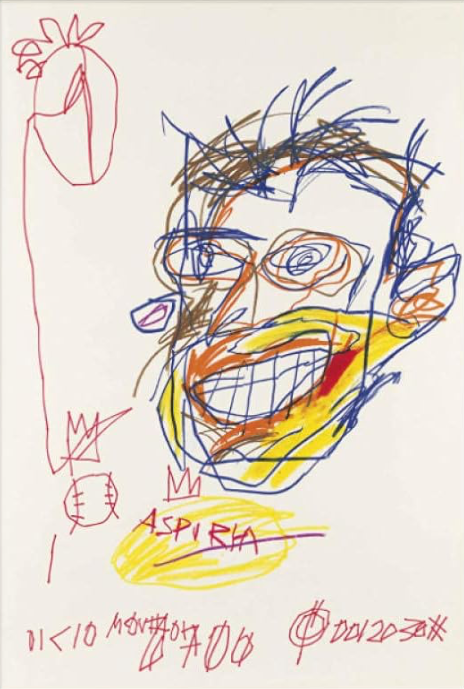

Art & Collectibles

Our Art & Collectibles strategy delves into the world of culture and creativity. We invest in valuable established artworks and collectibles, appreciating both their aesthetic and financial worth.

Web 3.0

We navigate the ever-evolving digital frontier, investing in specialist funds focused on blockchain technologies, cryptocurrencies and Web 3.0 companies to capture opportunities in this exciting and innovative space.

Renewable Energy

Embracing renewable resources such as sunlight, wind, water, and geothermal heat, is pivotal for a sustainable future. Our strategic investments in this sector are a growing long term goal.